Join us on IRC or via your preferred IRC platform via libera.chat #boardgames. If you're looking to schedule an AMA, set-up a live event post, or collaborate with us in any way, reach out via modmail! New user on the sub? Please make sure you read our rules below and check out our Contribution Guides since we have additional rules regarding specific topics. Ironically new measures to address the housing shortfall, notably rent control and inclusionary zoning, may help some people, but will likely further slow new construction.Flair icons are BoardGameGeek microbadges and are used with permission. Now, for the first time in recent memory, there are more Chinese sellers than buyers as sales falter. Other factors such as the gradual withdrawal of Chinese buyers, in large part due to Beijing’s own financial problems, could play a role, particularly in places like California and New York. Already many analyses show that the apartment markets here, and elsewhere, including places like New York and Seattle, are doing worse than before, with rents stagnating or even declining. Instead, we may be overbuilding small expensive apartments. The state, sadly, seems to have little interest in meeting the demand of young families, posing a long-term demographic threat. Already the price differences between our state and the rest of the country are greatest, notes demographer Wendell Cox, at the lower, “starter” end of the market. A recent National Homebuilders Association report shows more than two in three Millennials, including most of those living in cities, would prefer a house in the suburbs, findings confirmed as well by the Conference Board and Nielsen.īy trying to stamp out suburbia, California is playing fire with its own future. Over the last year, according to the Census, the ranks of renters decreased while homeownership increased 1.8 million. Instead of flocking permanently into dense cities, more millennials are following in the footsteps of previous generations by locating on the periphery of major metropolitan areas and sunbelt cities, most of which are simply agglomerations of suburbs. The rising cost and declining sales also reflect to some extent the inability of governments and developers to catch new demographic trends. Then there’s the return of the home equity loan market back to its pre-recession level. There are other clear disturbing signs, such as the rising percentage of buyers paying 45 percent of their income on mortgages the number is four times the percentage in 2010. Higher interest rates tend to undermine the viability of high-priced markets in particular. We could be setting the stage for a new kind of housing debacle - and not only here. By one recent calculation by, California, with the exception of Hawaii, has by far the highest statewide gap - almost $50,000 - between the salary needed to buy a house and its price. This is all part of a toxic regulatory overreach that led California housing prices, relative to incomes, to grow at three times the national rate since 2010. New state legislation, seeking to expand Jerry Brown’s climate jihad, including new mandates for solar roofs for new houses, promise to raise prices by at least $20,000 and without doing much for the environment, warns environmentalist Mike Shellenberger. Stronger land-use regulations have been associated with higher land cost and regulatory delays driving house prices well beyond historic norms, as recent research indicates.ĭue to lack of affordable new product, prices have remained high, absurdly so in some areas. The shortfall in single-family home production, greatly discouraged by state policies, lagged even further.

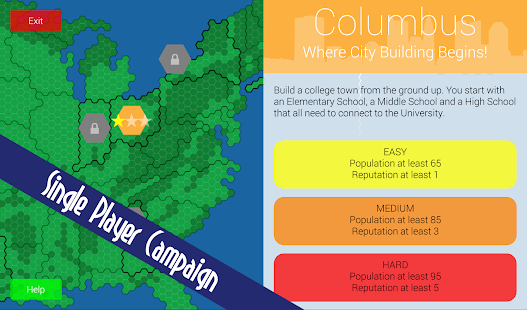

By 2017, California metros like Los Angeles-Orange and even the Bay Area were producing housing at half to one-third the rate, on a per capita basis, of places such as Nashville, Dallas, Houston, Orlando and even Indianapolis and Columbus. The unsurprising slowdown in housing after the Great Recession was further hampered, once the economy began to recover, in large part due to tough regulations.

The urbanist punditry helpfully came out in force to declare such areas as “the next slums”.

This is particularly true in California, which took one of the biggest hits in 2008 as its sky-high prices collapsed, causing enormous problems in areas including the Inland Empire, where incomes are lower and the economy was largely built around new housing construction. Yet before breaking out the Champagne, we should recognize that the hangover is not yet over, and that a new housing crisis could be right around the corner. We may be celebrating - if that’s the right word - the tenth year since the onset of the financial crisis and collapse of the real estate market.

0 kommentar(er)

0 kommentar(er)